Understanding where your money goes is vital to building long-term wealth.

Creating and sticking to a budget is a smart way to achieve this.

Fortunately, there are many apps out there to help you with budgeting, but which one should you choose?

We’ve done the research on the most popular ones, and in this article, we will showcase the best apps for budgeting to make your decision easier.

Table of Contents

ToggleBest Apps for Budgeting

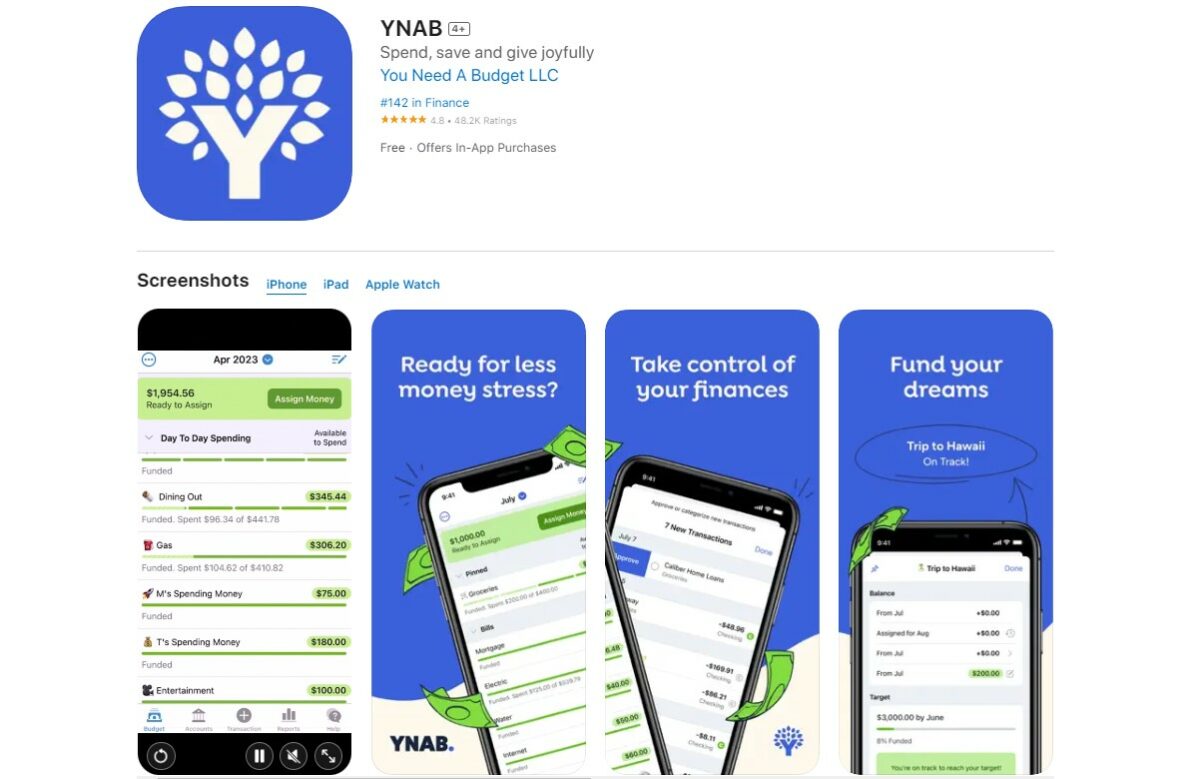

1. You Need A Budget

YNAB revolutionizes budgeting with its innovative approach.

Unlike traditional methods, YNAB encourages a proactive budgeting mentality by urging individuals to assign every dollar a specific purpose.

This approach not only ensures that each dollar is accounted for but also instills a sense of financial mindfulness.

One of YNAB’s standout features is its real-time tracking capability.

As you spend, the app immediately updates your budget, providing you with a clear and up-to-date overview of your financial situation.

Whether a daily coffee or a monthly utility bill, YNAB ensures you always control your spending.

Additionally, YNAB provides insightful reports that go beyond basic tracking.

These reports offer detailed analyses of your spending patterns, highlighting areas where you can optimize and save.

By leveraging this information, users can make informed decisions about their finances, ultimately paving the way for long-term financial success.

Key features

- Innovative approach encouraging proactive budgeting.

- Real-time tracking for staying in control.

- Insightful reports for informed financial decisions.

2. Goodbudget

Goodbudget caters to those who appreciate the simplicity of the age-old envelope budgeting method.

The app translates this tangible practice into a digital format, allowing users to allocate funds to virtual envelopes.

This mirrors the process of physically separating cash into different categories, making budgeting more tangible and straightforward.

The strength of Goodbudget lies in its user-friendly design coupled with robust features.

Navigating through the app is intuitive, making it accessible for individuals who may not be tech-savvy.

Users can easily create virtual envelopes for various spending categories, enabling them to see and manage their budgets with ease visually.

Beyond simplicity, Goodbudget offers powerful budgeting tools.

You can set spending limits for each envelope, receive alerts when approaching those limits, and track progress effortlessly.

The user-friendly design and powerful features make Goodbudget an ideal choice for those seeking a practical and effective budgeting solution.

Key features

- Digital companion for the envelope budgeting method.

- Allocates funds to virtual envelopes for precise categorization.

- User-friendly with robust features for effective budgeting.

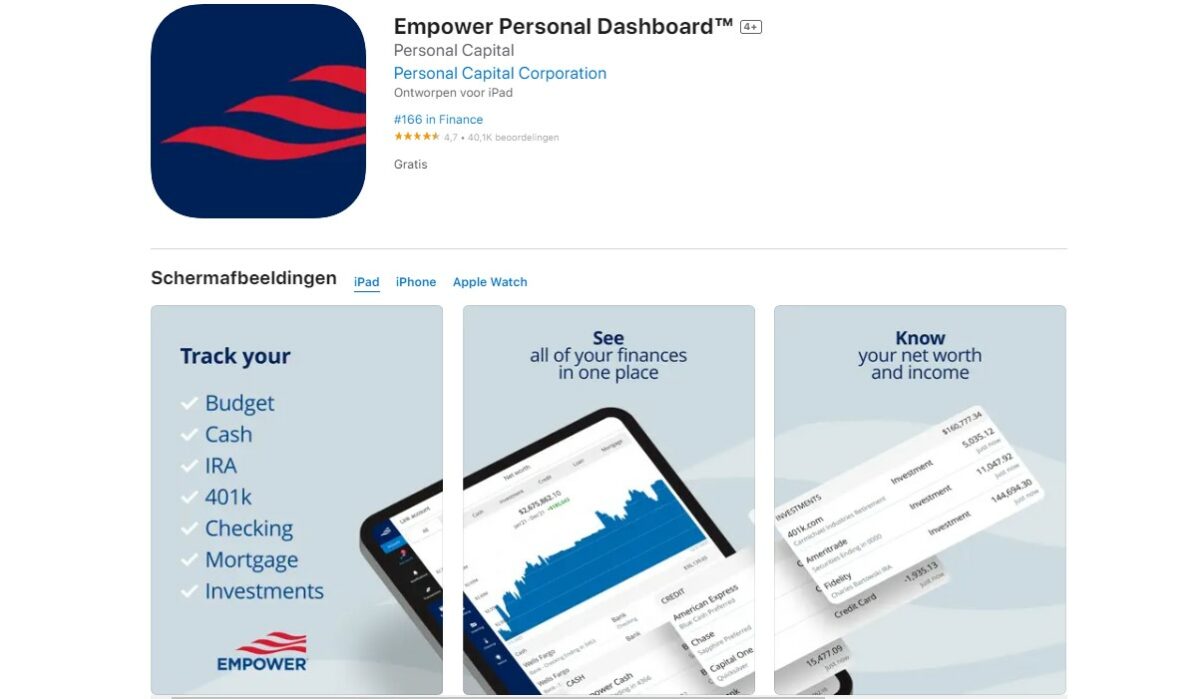

3. Empower Personal Dashboard

Empower Personal Dashboard redefines financial management with a holistic approach.

Beyond the conventional budgeting features, this app is a comprehensive financial assistant.

It analyzes your income and spending patterns, providing personalized suggestions to optimize your financial habits.

Empower ensures that you not only track your spending but also actively work towards economic empowerment.

The app’s real strength lies in its AI-driven insights.

By leveraging artificial intelligence, Empower goes beyond basic tracking, offering tailored recommendations based on your financial behavior.

Whether saving more, cutting unnecessary expenses, or optimizing investments, Empower Personal Dashboard is a dynamic guide toward financial success.

Key features

- An all-around financial helper who looks at your income and expenses.

- Insights based on AI for individual financial optimization.

- Helps people become financially independent.

4. EveryDollar

EveryDollar, spearheaded by financial expert Dave Ramsey, embodies simplicity with a purpose.

Following a zero-based budgeting system, EveryDollar ensures that every dollar is assigned a specific role.

This straightforward approach aligns with Ramsey’s philosophy of intentional spending, allowing you to take control of your money with clarity and purpose.

The app’s user-friendly interface facilitates easy navigation.

You can quickly input income and allocate funds to various spending categories, gaining a real-time understanding of where your money is going.

EveryDollar transforms budgeting from a complex chore into a manageable and actionable process, making it an invaluable tool for those striving for financial discipline.

Key features

- Zero-based budgeting system for intentional spending.

- User-friendly interface for easy navigation.

- Transforms budgeting into a manageable and actionable process.

5. Oportun App

Formerly Digit, Oportun introduces a seamless way to save effortlessly.

This app employs artificial intelligence to analyze your spending habits, automatically transferring small amounts to a dedicated savings account.

Oportun operates as a silent financial ally, working behind the scenes to build your savings without disrupting your daily financial flow.

The key strength of Oportun lies in its subtle automation.

You need not actively initiate saving; Oportun’s AI takes care of it.

This approach ensures that you consistently build your savings without thinking about it.

Oportun, with its discreet yet effective savings strategy, stands out as a practical choice for those looking for hassle-free financial growth.

Key features

- AI for effortless saving, analyzing spending habits and automatically transferring small amounts to savings.

- Quietly builds savings without user initiation for an effective savings strategy.

- Intuitive design ensures easy navigation for a seamless user experience.

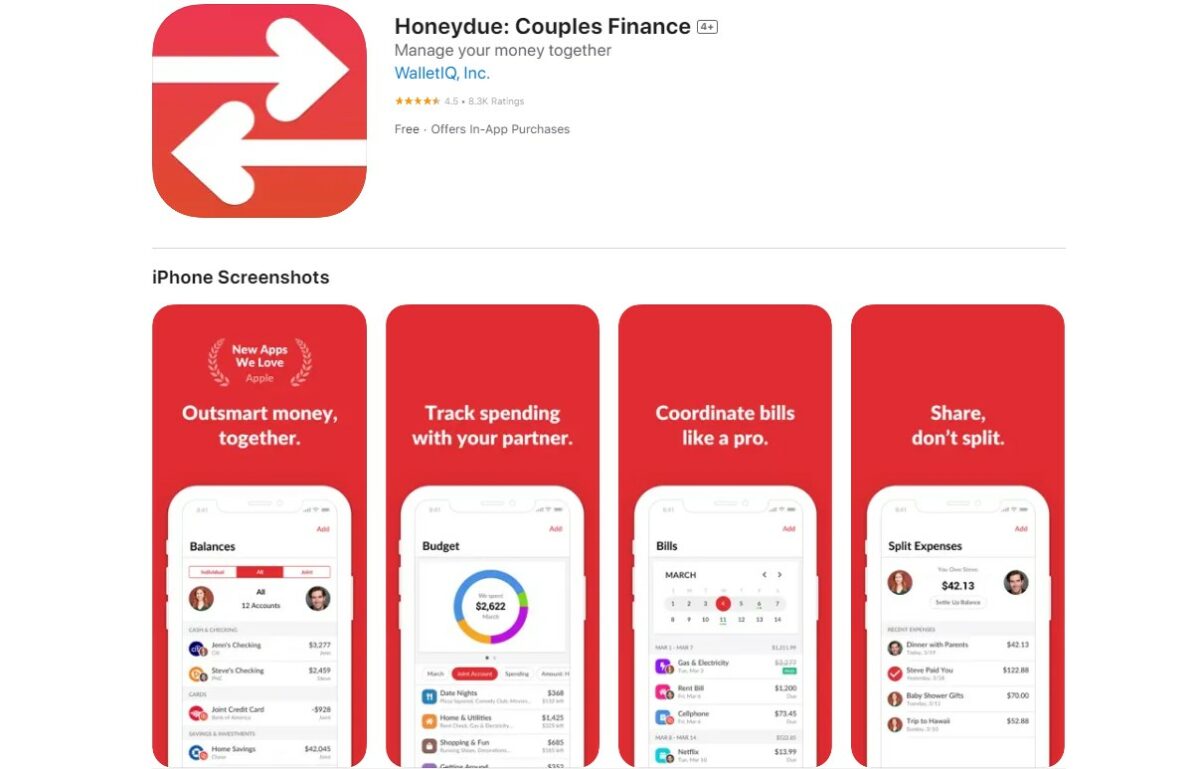

6. Honeydue

Honeydue transforms the landscape of financial management, especially for couples.

This app provides a platform where you and your partner can sync your financial accounts, track shared expenses, and set budgeting goals together.

It fosters transparency in financial matters, allowing you to stay on the same page and work towards common financial objectives.

The strength of Honeydue lies in its collaborative features.

You can easily track expenses, manage bills, and set spending limits together so that you make financial decisions jointly, reducing misunderstandings and promoting a healthier approach to shared finances.

With its user-friendly interface and shared financial insights, Honeydue makes managing finances as a couple more streamlined and efficient.

Key features

- A platform for couples to sync accounts and track shared expenses.

- Fosters transparency and joint decision-making.

- Efficient management of finances as a couple.

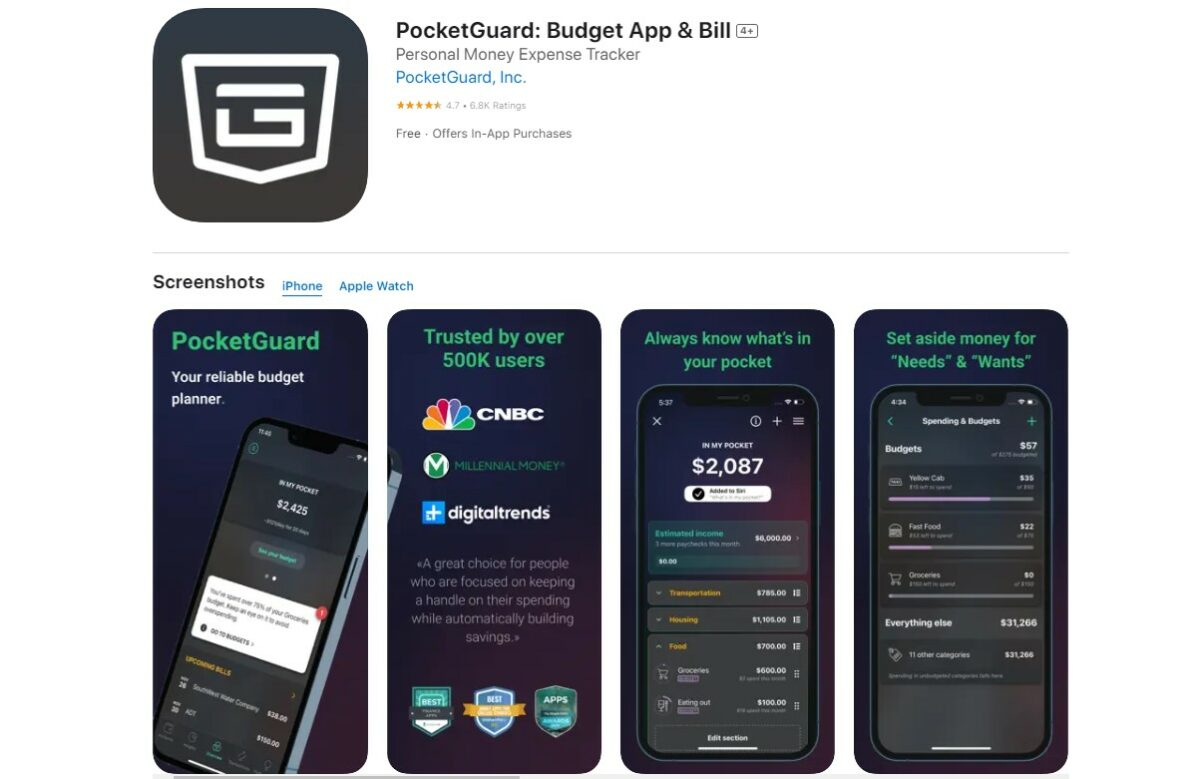

7. PocketGuard

Closing our list is PocketGuard, a powerful budgeting app that provides a 360-degree view of your financial landscape.

With features like spending analysis, bill tracking, and personalized budget recommendations, PocketGuard is your financial GPS, guiding you toward more intelligent money management.

PocketGuard’s real strength is its ability to offer comprehensive financial insights.

The spending analysis feature categorizes your expenses, giving you a clear breakdown of where your money is going.

It goes beyond basic budgeting, providing actionable recommendations to optimize your spending habits.

With PocketGuard, you track your expenses and gain valuable insights to make informed financial decisions.

Key features

- Categorizes expenses for clear insights into spending habits.

- Helps keep track of bills, ensuring timely payments and avoiding late fees.

- Offers actionable suggestions for optimizing spending habits, providing customized insights for better financial decisions.

How These Budgeting Apps Can Help You

Simplified Expense Tracking

Budgeting apps offer a straightforward way to track your spending.

They enable you to monitor your expenses in real-time, clearly showing where your money is going.

This simplifies financial decision-making and allows you to identify potential areas for savings.

Automated Savings Boost

Many budgeting apps leverage automation to make saving easier.

These apps can automatically transfer small amounts to your savings by analyzing your spending patterns.

It not only promotes consistent saving but also helps you build a financial safety net for unforeseen expenses or future financial goals.

Better Financial Collaboration

Some budgeting apps cater to collaborative financial management.

Whether you’re managing finances as a couple or within a group, these apps facilitate syncing accounts, tracking shared expenses, and ensuring everyone is aligned on financial goals.

Comprehensive Financial Insights

Certain budgeting apps provide a holistic view of your financial situation.

From analyzing spending patterns to tracking bills, these apps offer insights that empower you to make informed decisions about your money.

It’s like having a personal financial advisor at your fingertips.

Frequently Asked Questions

Are budgeting apps secure?

Reputable budgeting apps use advanced security measures to protect your financial information.

Always choose apps from trusted sources and review their security features before using them.

Can I access budgeting apps across different devices?

Most budgeting apps offer cross-device functionality, allowing you to access your financial information from smartphones, tablets, or computers.

Ensure the app you choose is compatible with the devices you commonly use to manage your finances.

Can budget apps help me save money?

Absolutely.

Many budgeting apps, like Oportun, use automation to help you save effortlessly.

By analyzing your spending patterns, these apps identify opportunities for saving and transfer small amounts to your savings account.

Conclusion

Mastering your finances has never been easier with our selected best apps for budgeting.

Whether you aim to save more, spend wisely, or simply better understand your financial habits, these applications cater to diverse needs.

Choose the one that aligns with your preferences and embark on a journey towards economic empowerment.